defer capital gains tax canada

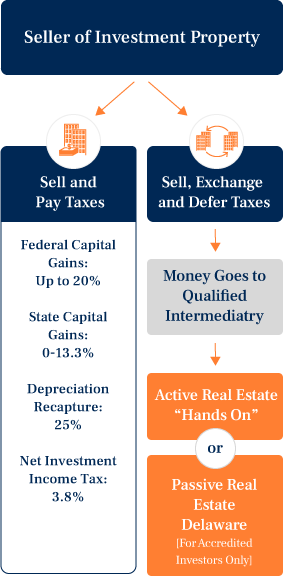

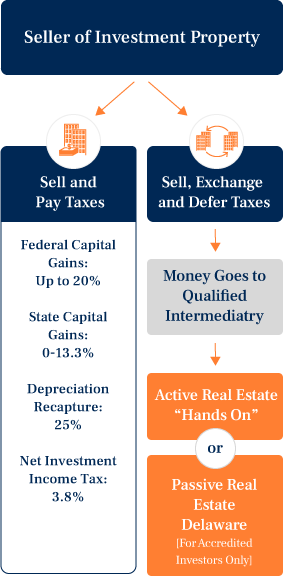

Capital gain Amount payable after the end of the year Proceeds of disposition Using the example above 333 of your Capital Gain can be deferred using the reserve. Tax-Deferred Exchange Many people refer to this arrangement as a tax-free exchange but capital gains are not actually tax-free.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital gains deferral B x D E.

. In Canada 50 of the value of any capital gains are taxable. The maximum allowable reserve in. This can be done using Section 1031 of the tax.

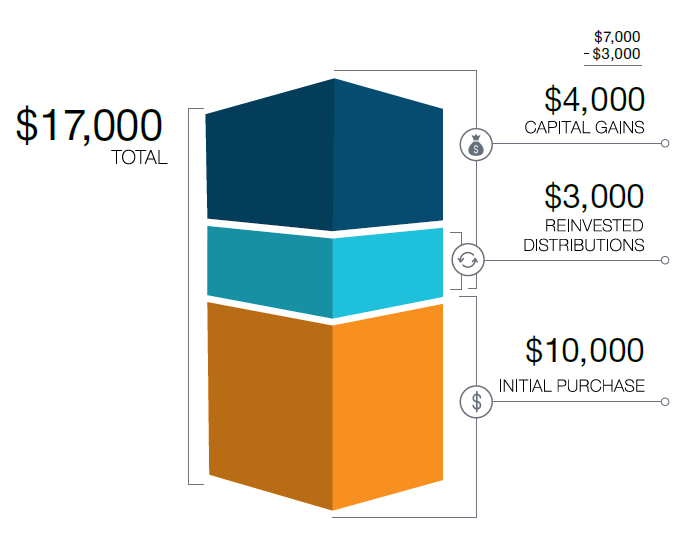

Should you sell the investments at a higher price than you paid realized capital gain youll need to add. When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

The 1031 Exchange does allow you to defer the payment of taxes in the US but there is nothing that Im aware of in Canada. One year is the dividing line between having to pay short term. Capital gains deferral B D E where B is the total capital gain from the original sale.

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Capital Gains Tax Rate. If you have a capital gain on the sale of real estate but have not received the entire payment you can actually defer paying tax on that capital gain by using the capital gains.

This deferral applies to dispositions where you use. 7 Methods for Investors 2 days ago May 31 2022 Strategy 1. How to Defer Capital Gains Tax.

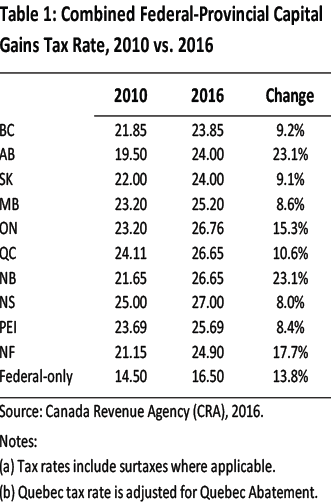

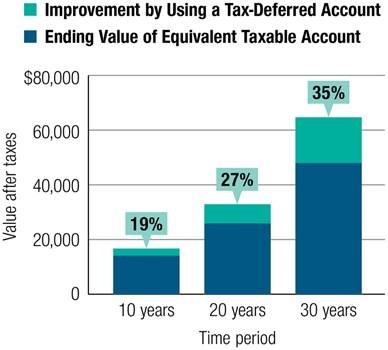

Deferral election is not taken but can claim CCA Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly. Capital gains realized by investors are currently subject to tax on only half of the gain. The CRA allows taxpayers to defer their capital gains tax burden by up to three years meaning you can defer either your losses or your gains to years when it will have the most.

Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021. E is the proceeds of disposition and D is the lesser of E and the total cost of all. Sell the Property After 1 Year.

Rather it is deferred into another property. It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales. You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be able to.

Whether realized corporately or personally capital gains currently have an effective tax. There are a few ways to avoid or minimize your capital gains tax in Canada. The first way to avoid paying capital gains tax on rental property in Canada is to defer the sale of your property to a later date.

In Canada you only pay tax on 50 of any capital gains you realize. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free. The 1031 Exchange is the holy grail of tax deferral opportunities.

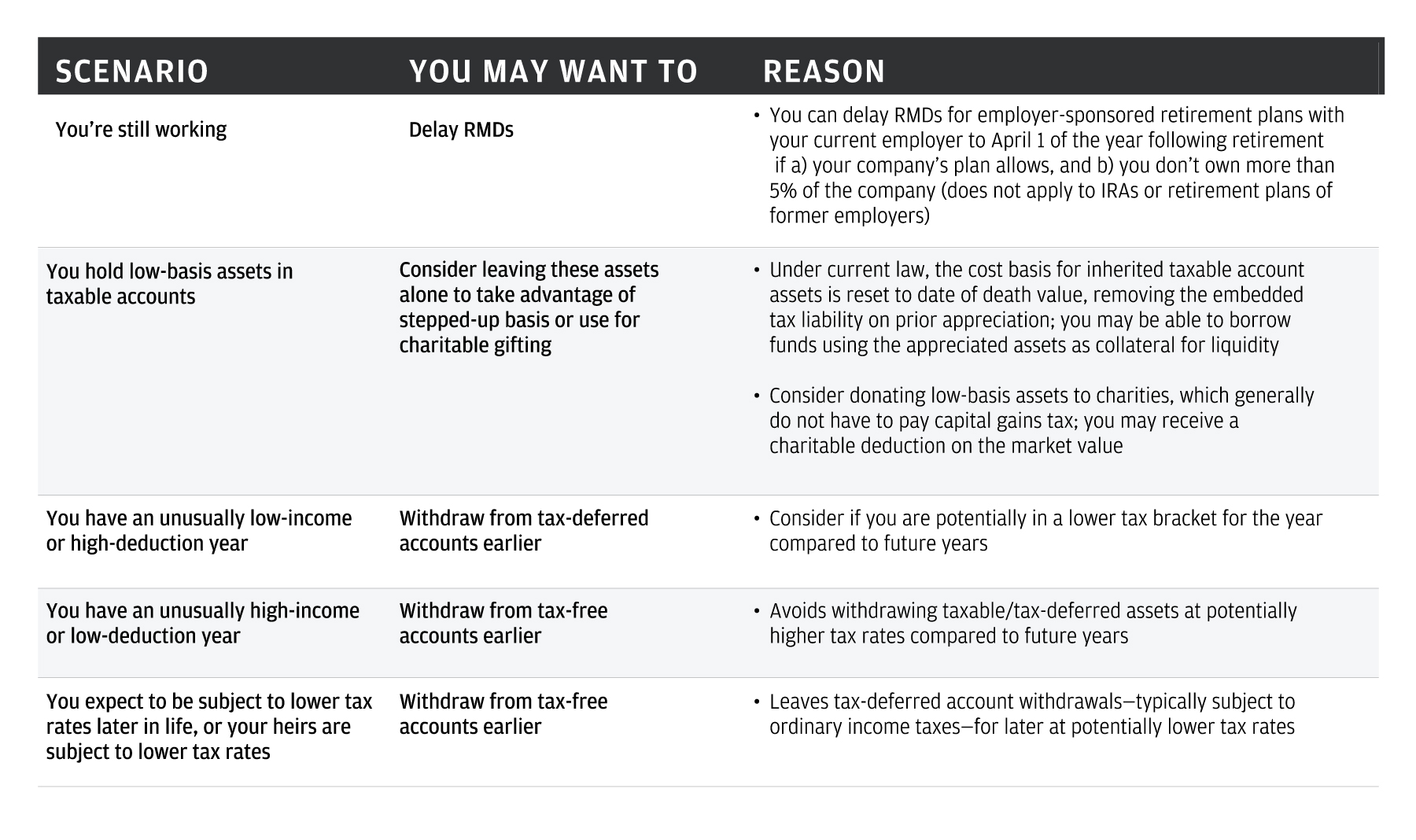

Capital gains from a mortgage foreclosure or a conditional sales repossession will be excluded from net income when calculating your claim for the goods and services taxharmonized sales. 4 FINAL TAX RETURN AND TAX DEFERRAL Since it will include your departure date the change will be confirmed when you file a final tax return by April 30 of the year. Keep eligible assets in tax-sheltered registered accounts such as Tax-Free Savings Account TFSA.

They might decide to do this if they had capital losses to offset the capital gain or if they had business losses that would reduce their taxable income. The permitted deferral of the capital gain from the disposition of eligible small business corporation shares is determined by the following formula.

Capital Gains Tax Deferral Capital Gains Tax Exemptions

End Of Year Tax Considerations For Capital Gains Understanding Mutual Fund Distributions T Rowe Price

Canadian Change Of Use Rules For Cross Border Real Estate Cardinal Point Wealth Management

What Is Tax Gain Harvesting Charles Schwab

Personal Income Taxes And The Capital Gains Tax Fraser Institute

How To Make The Most Of Your Savings Using A Tax Efficient Approach T Rowe Price

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Canada Capital Gains Tax Calculator 2022

How To Avoid Canada S Capital Gains Tax Private Advisory Vancouver Bc

/cloudfront-us-east-1.images.arcpublishing.com/tgam/6X6BMLM5VNBAPBFZFTDIJ32LSM)

Six Creative Ways To Defer A Tax Bill For Years Or Decades The Globe And Mail

Capital Gains Tax Hike And More May Come Just After Labor Day

1031 Exchange Investment Properties Marcus Millichap

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

.jpg)

Defer Capital Gains By Investing In Qualified Opportunity Funds Bny Mellon Wealth Management

How To Defer Capital Gains Tax On Real Estate Sales Madan Ca

75 Capital Gains Tax Promised To Canadians By Ndp R Canadianinvestor

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca